most undervalued stocks asx

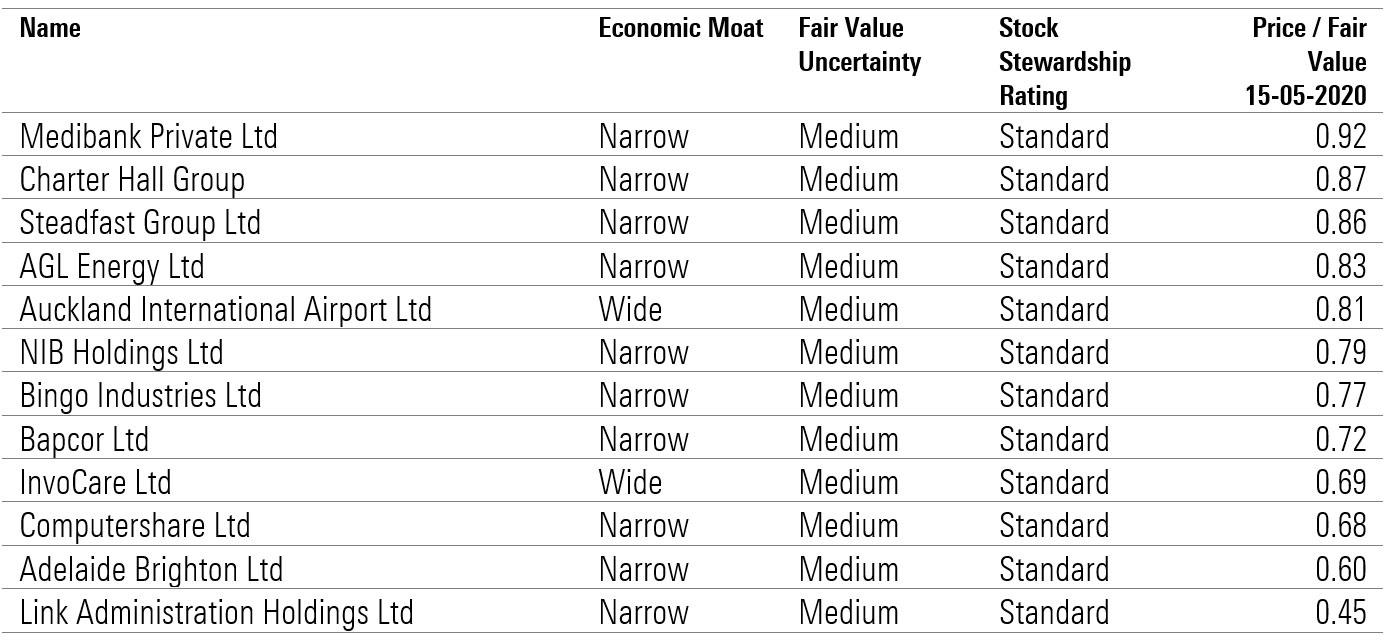

10 least volatile stocks in AU Market 45 Stable Share Price. Discovering undervalued stocks is the modus operandi of value investors.

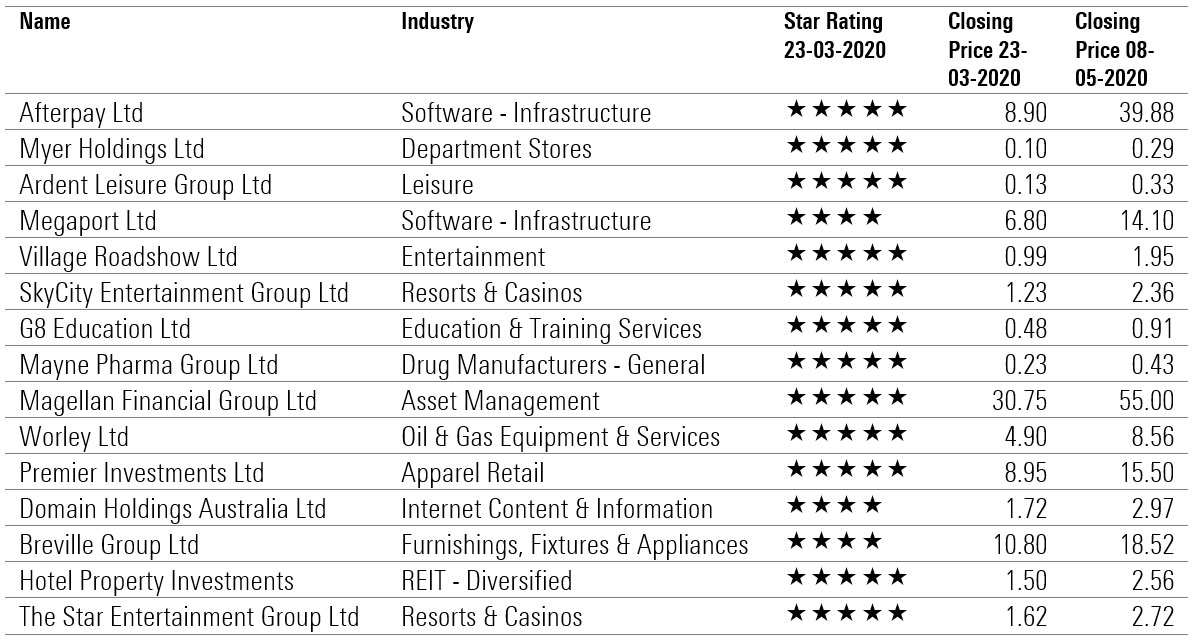

12 Undervalued Stocks If You Re Worried About Volatility Morningstar Com Au

ASE Technology Holding Co Ltd.

:max_bytes(150000):strip_icc()/smsi-dc5ac143acc44608b6ddae2ee6e755ca.jpg)

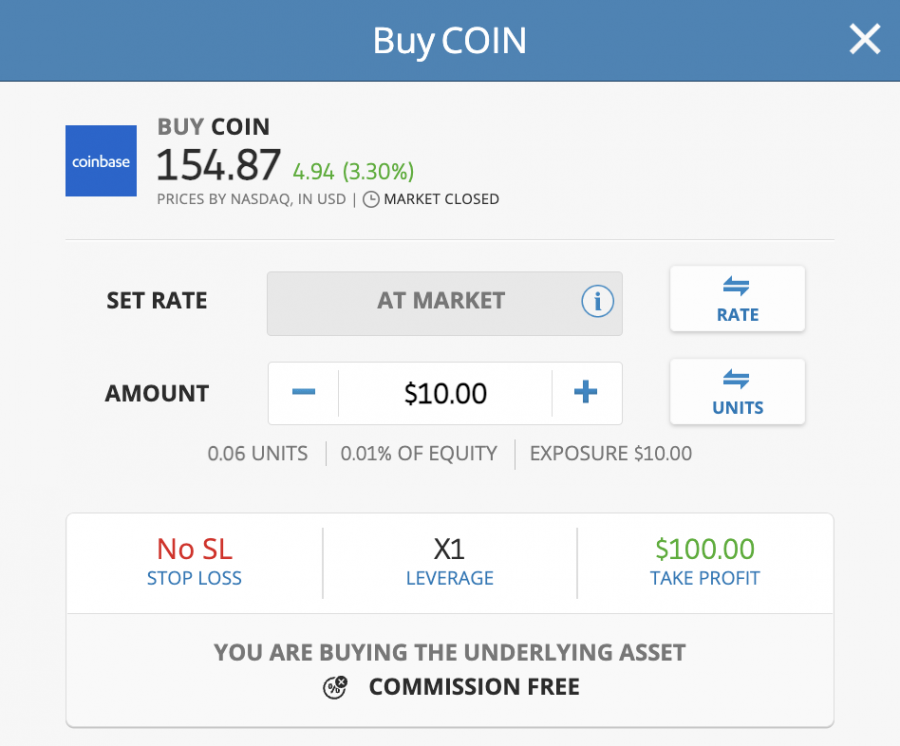

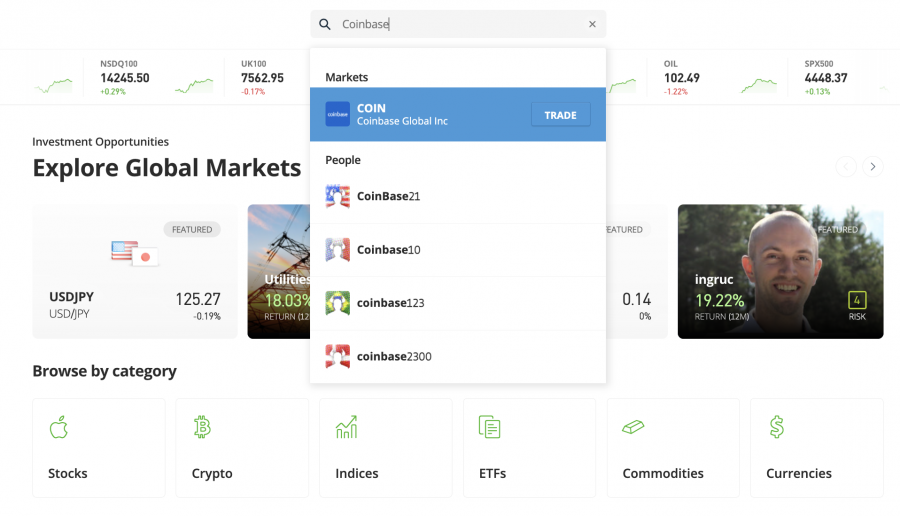

. The strategy is epitomised by the most famous one of all Warren Buffett who. 0 brokerage on US shares and 5 on ASX trades. Today well look at the best shares to buy right now that we think are undervalued stocks on the ASX in 2022.

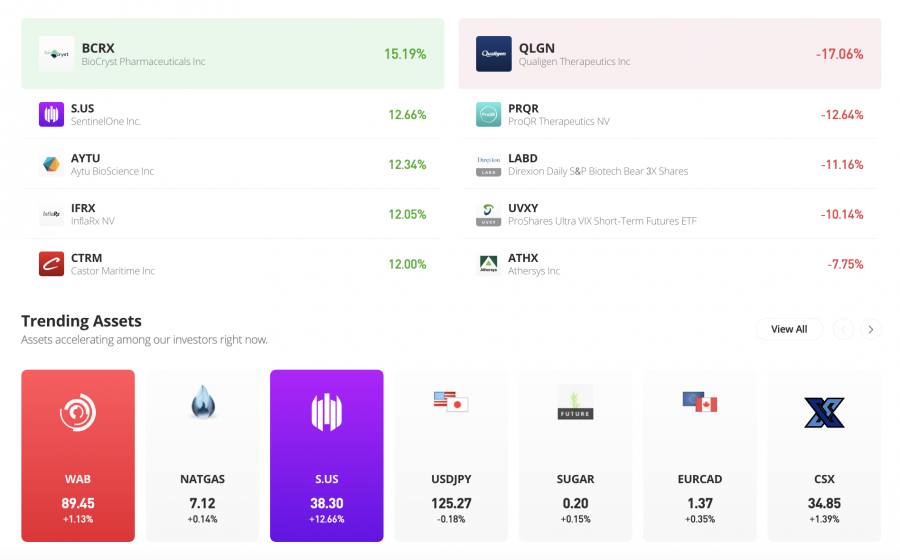

Heatmap ASX 200 Price Change by Sector Equities by Economic Sectors Equities by Industry Groups Price Change by Stock 1 day 5 days 1 week 1 month 3 months 6 months 1 year 3 years 5 years 10 years 1st jan. Undervaluation can come from a few factors these include competition strength higher risk future valuations and most commonly intrinsic value missed by. NYSEASX declared an annual dividend on Tuesday June 7th.

This payout ratio is at a healthy sustainable level below 75. IDP Education Limited is not the largest company out there but it saw a decent share price growth in the teens level on the ASX over the last few monthsAs a mid-cap stock with high coverage by analysts you could assume any recent changes in the companys outlook is already priced into the stock. 3 ways to find undervalued stocks.

Detailing 5 ASX stocks that they think could be fantastic stocks to own as investors. Find Yahoo Finance-predefined ready-to-use stock screeners to search for stocks by industry index membership and more. Most would say this shows a good degree of alignment with shareholders especially in a company of this size.

Insiders own AU21b worth of shares in the AU12b company. The ex-dividend date is Wednesday June 29th. PLS is not significantly more volatile than the rest of Australian stocks over the past 3 months typically moving - 11 a week.

Buy ASX and US shares online with Superhero. A couple of brokers believe the current Pilbara Minerals share price is significantly undervalued. Our most recent data indicates that insiders own a reasonable proportion of Xero Limited.

This is a positive change. ASX has a dividend yield higher than 75 of all dividend-paying stocks making it a leading dividend payer. BNPL stocks on the ASX have shed most of their value over the past year with many down over 90.

The dividend payout ratio of ASE Technology is 3273. This represents a dividend yield of 8. Shareholders of record on Thursday June 30th will be given a dividend of 04794 per share by the semiconductor company on Thursday August 4th.

ASE TechnologyNYSEASX pays an annual dividend of 036 per share and currently has a dividend yield of 702. CSL shares rose 068 to 26176 while the ASX 200 Index fell 020 today The global biotechs share price was supported by an uptick across the ASX 200 Health Care index Both Citi and Morgan. Create your own screens with over 150 different screening criteria.

Facebook Twitter LinkedIn Whatsapp Email Print If there is one market sector that encapsulates the rapid change in share market sentiment this year it is the buy now pay later BNPL sector. Buy stocks online with the Superhero app.

9 Top Sustainable Stocks That Are Undervalued Now Morningstar

/wrap-e8cd8b20e41641c0b6cc095ed856073c.jpg)

Penny Stocks To Watch In June 2022

.jpg)

The 10 Top Tipped Small Caps For 2022 Ally Selby Livewire

Most Undervalued Stocks To Buy In July 2022

Most Undervalued Stocks To Buy In July 2022

7 Undervalued Stocks With Growing Dividends Morningstar

11 Newly Undervalued Wide Moat Stocks Morningstar

Most Undervalued Stocks To Buy In July 2022

Asx Growth Stocks Top 10 Australian Shares To Watch In 2022 Ig En

5 Best Growth Stocks With 10x Potential To Buy 2022 Mint

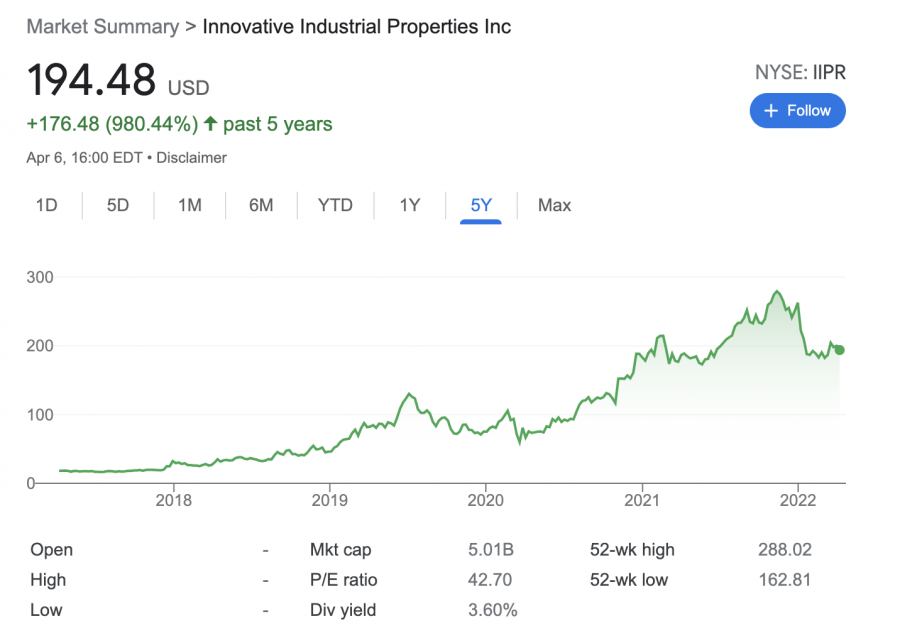

Undervalued Stocks Storm Back Morningstar Com Au

:max_bytes(150000):strip_icc()/smsi-dc5ac143acc44608b6ddae2ee6e755ca.jpg)

Penny Stocks To Watch In June 2022