peoples pension tax relief

Make an Informed Purchase. Ad Apply For Tax Forgiveness and get help through the process.

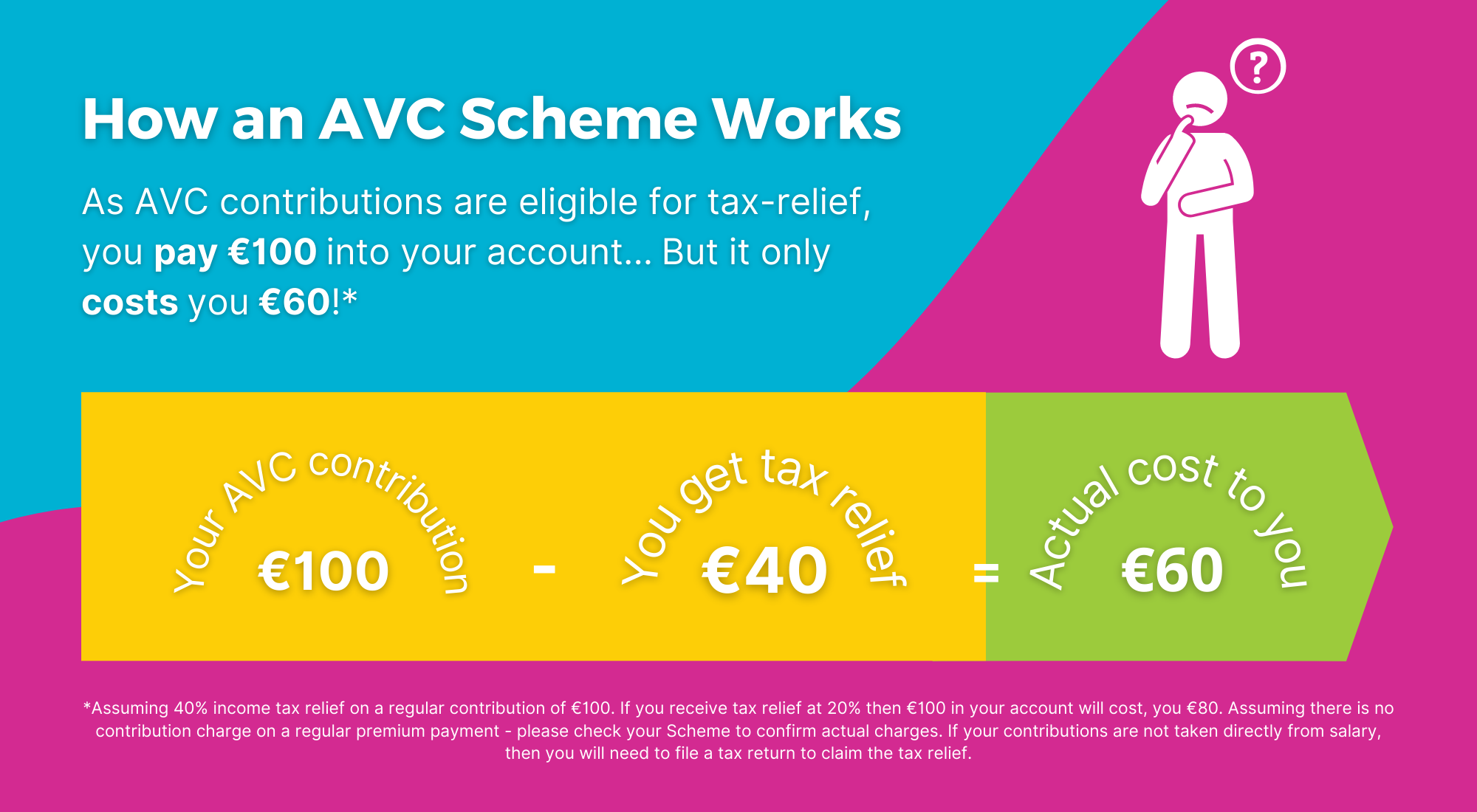

Avc Pension What Are Avcs How To Maximise Pension Benefits

End Your Tax Nightmare Now.

. Peoples Tax Relief provides tax debt services to consumers throughout all 50 states and US Territories. Find and Compare the Best Tax Relief Based on Price Value Ratings Reviews. The professionals at Peoples Tax Relief are experienced in settling tax problems.

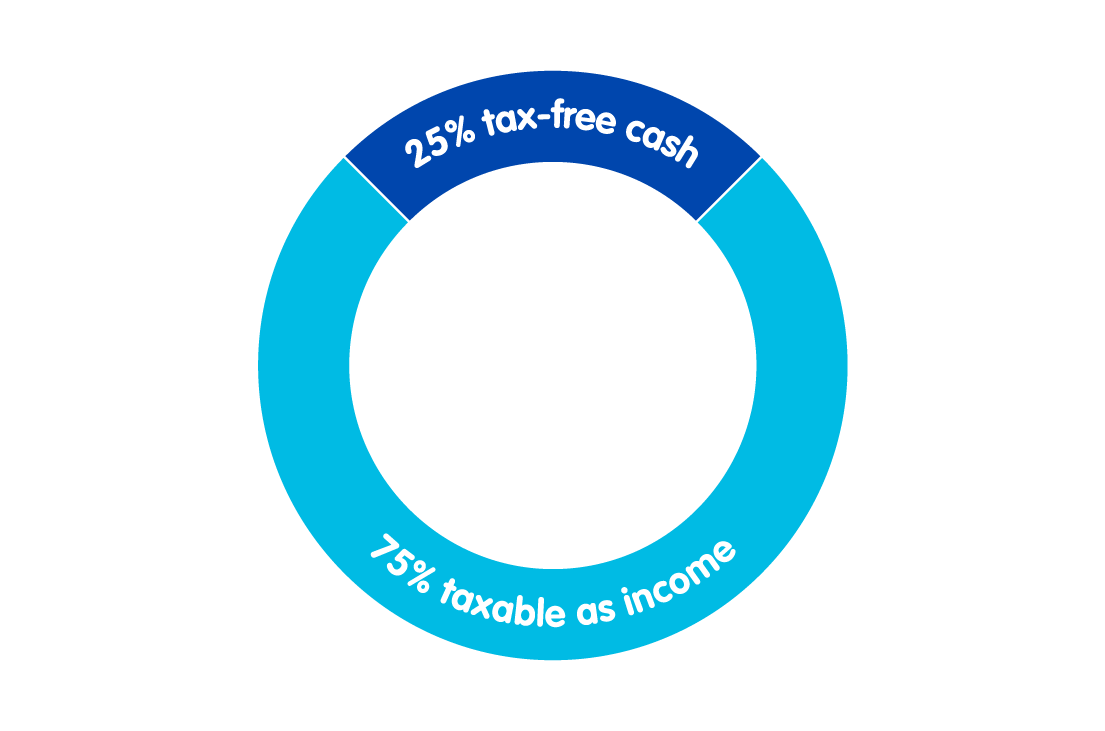

Ad 5 Best Tax Relief Companies 2022. Solve Your IRS Tax Debt Problems. The amount you can take depends on the type.

Our expertise regarding current tax law and our dedication to customer service are invaluable assets in your. End Your Tax Nightmare Now. 100 Money Back Guarantee.

If federal income is less than 75000 Social Security is exempt. End Your Tax Nightmare Now. Resolve Back Taxes For Less.

You can receive up to 46 pension tax relief for the 201819 tax year by contributing to a pension. You may see HM Revenue Customs HMRC referring to this as the. Ad Honest Fast Help - A BBB Rated.

You May Qualify to be Forgiven for Tens of Thousands of Dollars in Taxes. Ad As Heard on CNN. Tax relief on lump sums at retirement.

Solve All Your IRS Tax Problems. Ad 5 Best Tax Relief Companies 2022. Ad Read Expert Reviews of Tax Relief Services.

Four in ten 41 adults correctly believed that the government tops up peoples pension contributions through tax relief. Know Your Options So You Can Protect Your Rights. You May Qualify to be Forgiven for Thousands of Dollars in Back Taxes.

800-732-8866 or Illinois Tax Department Exclusion for qualifying retirement plans. Peoples Pension Higher Rate Tax Relief. 20 up to the amount of any income you have paid 40 tax on 25 up to.

Every taxpayer gets basic rate income tax relief applied to their pension contributions at 20 up to the annual pension allowance of. A quarter 26 thought the government provides no. 100 Money Back Guarantee.

- BBB A Rating. Phone Number 732 752-0445. If youre an employer setting up your workplace pension with The.

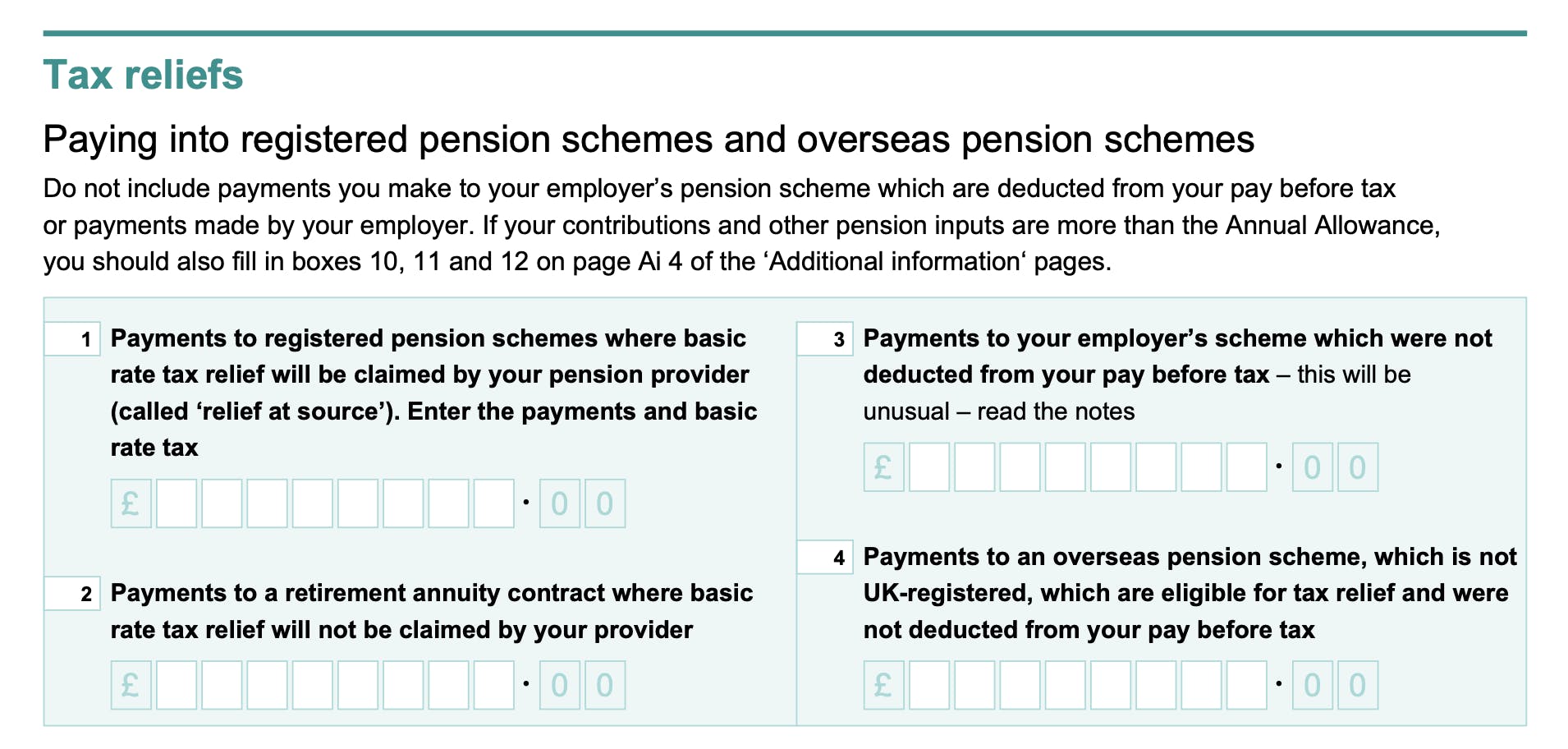

You can claim additional tax relief on your Self Assessment tax return for money you put into a private pension of. When you retire you can usually take part of your pension fund as a tax-free lump sum. - BBB A Rating.

That works out as a 66 tax bonus. Ad Based On Circumstances You May Already Qualify For Tax Relief. You May Qualify to be Forgiven for Thousands of Dollars in Back Taxes.

Ad Honest Fast Help - A BBB Rated. Solve Your IRS Tax Debt Problems. Ad As Heard on CNN.

60 Tax Relief On Pension Contributions Royal London For Advisers

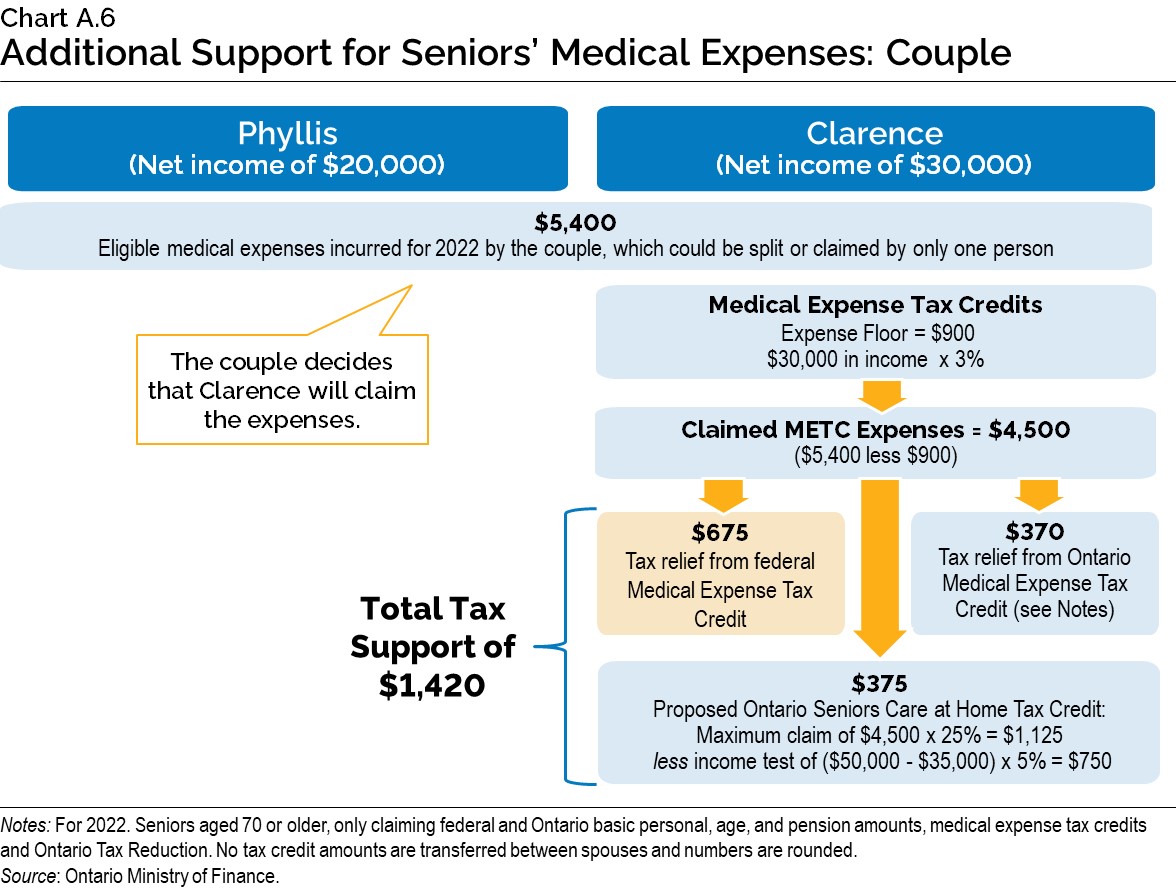

2019 Ontario Budget Chapter 1d

How Pension Tax Relief Works And How To Claim It Wealthify Com

Sipp Tax Relief Calculator Tax Relief On Pension Contributions

Salary Sacrifice Workplace Pensions The People S Pension

What Is Pension Tax Relief Nerdwallet Uk

Self Employed Pension Tax Relief Explained Penfold Pension

How Do Pensions Work Moneybox Save And Invest

Who Benefits More From Tax Breaks High Or Low Income Earners

Benefits And Entitlements For Pensioners And The Elderly

Pension Contributions In Ireland Pension Support Line

Tax Relief On Your Pension Youtube

Pension Tax Tax Relief Lifetime Allowance The People S Pension

Pension Tax Tax Relief Lifetime Allowance The People S Pension

Workplace Pension Contributions The People S Pension

Self Employed Pension Tax Relief Explained Penfold Pension

How To Add Pension Contributions To Your Self Assessment Tax Return